Staying Mindful & Budget-Friendly in Today’s Economy

The economy in 2025 is still shifting—groceries cost more, rent remains high, and essentials like energy and healthcare continue to stretch budgets. Yet, even with rising prices, there are simple ways to stay grounded and mindful while protecting your wallet.

Smart, Mindful Habits

Plan Meals & Shop Smart: Create weekly menus, buy in bulk, and choose store brands to cut grocery costs.

Be Energy Wise: Unplug unused electronics, switch to LED bulbs, and consider a smart thermostat for long-term savings.

Simplify Transportation: Use public transit, carpool, or work from home when possible to save on gas and wear and tear.

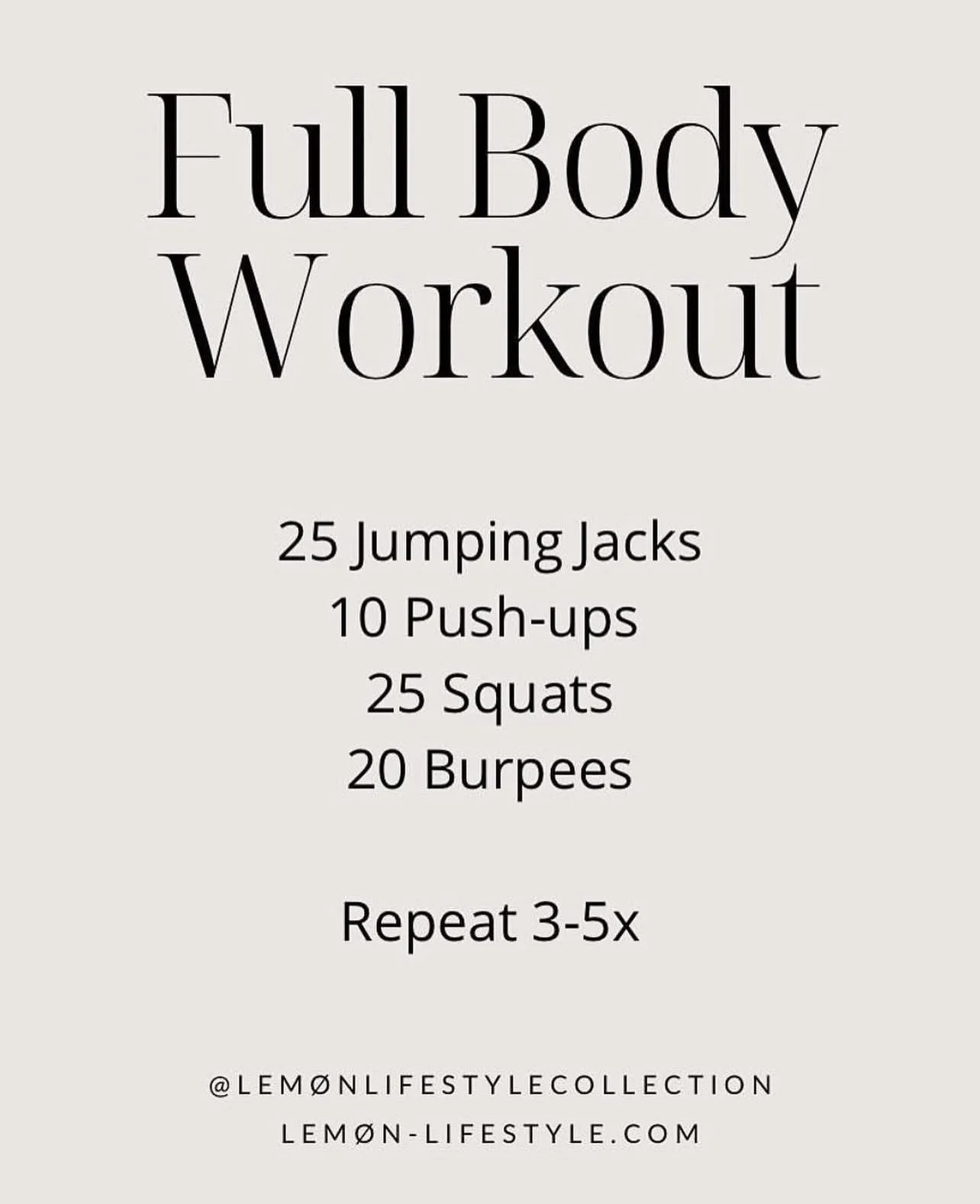

Choose Free Wellness Options: Practice mindfulness, meditate, or enjoy free fitness like community yoga, hiking, or at-home workouts.

Spend Consciously: Embrace thrift stores, free library resources, and no-spend days to avoid impulse buying.

Build Financial Resilience: Start or grow an emergency fund, use budgeting apps, and pay down high-interest debt first.

Mindfulness Matters

Simple practices like journaling, deep breathing, and limiting screen time reduce stress and help you appreciate what you already have. The key is slowing down, prioritizing needs over wants, and enjoying life’s simple, often free, pleasures.

Reflection

In moments of economic uncertainty, slowing down becomes powerful. Take time to breathe, enjoy the meals you prepare, savor walks outdoors, and connect with loved ones without spending a dime. Gratitude for the small things—morning sunlight, a hot cup of tea, or a quiet evening—reminds us that even in challenging times, peace and joy are within reach.